Efficient and reliable accounts payable services to streamline financial operations

Keep your payable organised with professional Accounts Payable Services

Businesses rely on reliable accounts payable services to strengthen supplier relationships and optimize working capital. In today's digital age, efficient accounts payable management is essential for timely payments and financial efficiency. Outsourcing this process saves time and offers financial oversight, while automated software ensures accuracy, minimizing errors and costs.

Our Outsourced Accounts Payable Services

Data capture services include

- Sorting

- Batch preparation

- Document indexing

- Auditing & Reconciliation

- Storage & Document Retrieval

- Processing of incoming mail

Data processing services include

- Exception handling and approval routing

- Aimed at minimising the month-end closing process

- Providing comprehensive audit trail documentation

Our services encompass suspect duplicate analysis

- Robust data control mechanisms

- Automated & manual data entry

- Three-way database matching

- Efficient e-invoice processing

Disbursement services include expedited handling of major payment components

- Efficient return cheque management

- Secure and streamlined stock checking

- Specialized invoice and mail handling services

- Electronic payment processing

- Online cheque verification

Other accounts payable services include

- Utility bill management

- Expenses and travel cost management

- Tax reporting management

- Supplier management

- Special project reporting

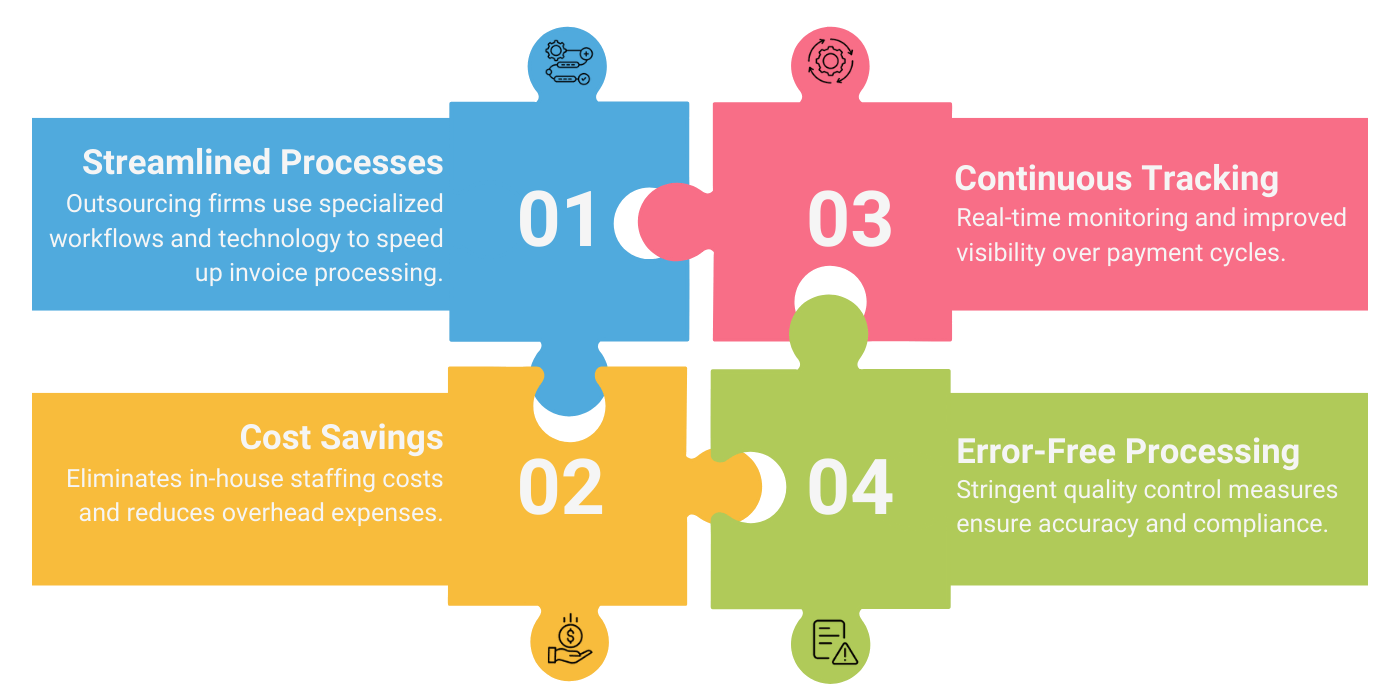

Benefits of Outsourcing Accounting Payable Services

Benefits of outsourcing accounts payable services for increasing efficiency:

FAQ

Frequently Asked Questions (FAQs)

Accounts payable services involve managing a company's obligations to pay off short-term debt to its creditors or suppliers. This includes processing invoices, making payments, and ensuring accurate recording and reporting of all transactions.

Efficient accounts payable services help maintain good supplier relationships, avoid late payment penalties, improve cash flow management, and ensure accurate financial reporting.

Tasks include processing and verifying invoices, managing purchase orders, reconciling vendor statements, scheduling and making payments, maintaining records, and handling inquiries and disputes with suppliers.

They ensure accuracy by implementing standardized procedures for invoice processing, using automation tools to reduce manual errors, and regularly reconciling accounts.

Yes, these services can help prevent fraud by implementing strict internal controls, segregation of duties, and regular audits to detect and prevent unauthorized transactions.

Many accounts payable services integrate with accounting software to streamline data entry, automate workflows, and ensure seamless updates to the general ledger.