Virtual CFO Services

Virtual CFO Services

Virtual CFO (Chief Financial Officer) services provide businesses with access to experienced financial expertise without the cost of a full-time executive. This service is particularly beneficial for small to mid-sized enterprises (SMEs) looking to optimise financial strategies, improve decision-making, and enhance overall financial health.

Virtual CFO services provide flexibility, expertise, and strategic financial management tailored to the unique requirements of your business. Whether you need ongoing financial oversight or specific project-based support, a virtual CFO can help optimise your financial strategies and drive business success.

Our Services Include

- Developing long-term financial goals and strategies aligned with business objectives.

- Forecasting financial performance and identifying opportunities for growth.

Financial Strategy and Planning

- Conducting in-depth financial analysis to provide insights into business performance.

- Generating comprehensive financial reports for stakeholders and management.

Financial Analysis and Reporting

- Monitoring cash flow patterns and optimizing cash reserves to ensure liquidity.

- Implementing strategies to manage working capital effectively.

Cash Flow Management

- Creating detailed budgets and financial forecasts to guide business decisions.

- Monitoring actual performance against forecasts and adjusting strategies as needed.

Budgeting and Forecasting

- Identifying and mitigating financial risks to protect business assets and ensure compliance with regulations.

- Implementing internal controls and procedures to safeguard financial integrity.

Risk Management and Compliance

- Providing strategic advice on mergers and acquisitions, capital raising, and investment decisions.

- Supporting business expansion initiatives and evaluating financial implications.

Strategic Advisory Services

- Preparing presentations and financial reports for board meetings and investor updates.

- Facilitating communication between management and stakeholders.

Board and Investor Relations

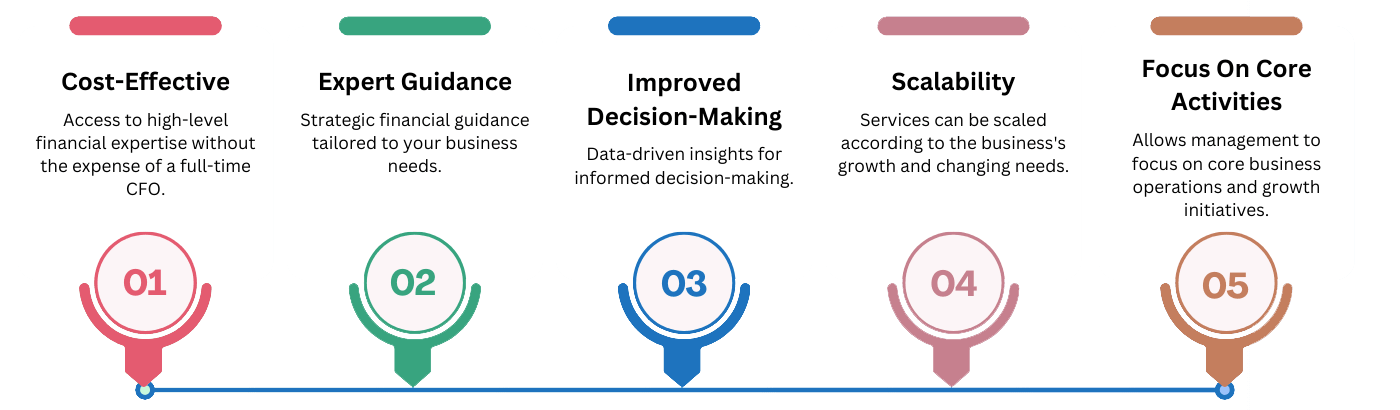

Benefits Of Virtual CFO Services