Efficient And Effective Online Bookkeeping

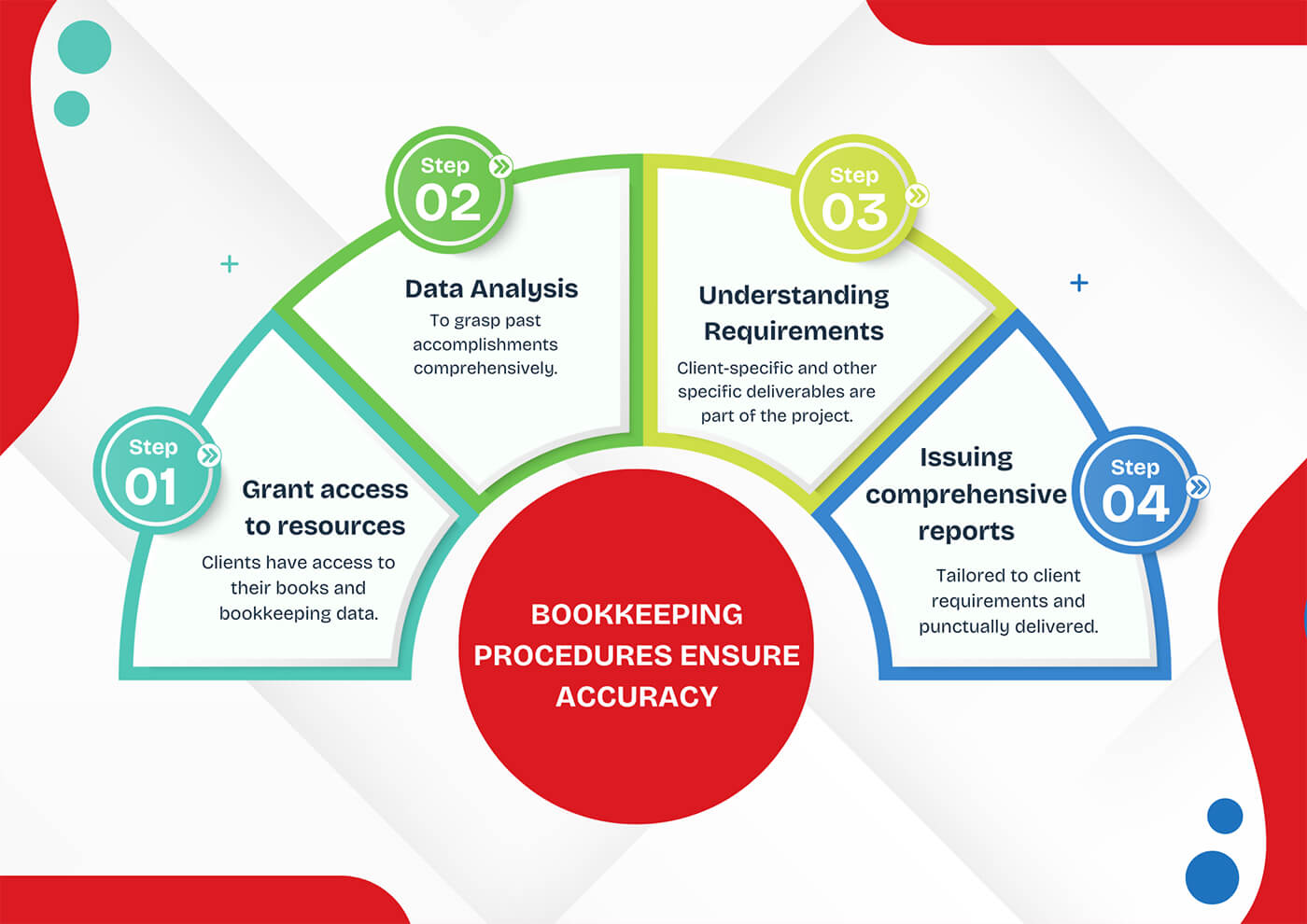

Bookkeeping procedures ensure accuracy

Start-Up

- Dedicated Bookkeeping Services

- Experienced Accounting Services

- Bank and Credit Card Reconciliation

- Accounts Payable and Receivable Management

- Payroll Calculation and TDS/PF/ESI Payments

- TDS Return Filing Services

- GST Return Filing Services

- Yearly Tax Return Filing

- Monthly Balance Sheet and Profit & Loss Reporting

- Financial Ratios Analysis and Reporting

- Monthly Cash Flow Reporting

Growing

- Dedicated Bookkeeping Services

- Highly Experienced Accounting Services

- Bank and Credit Card Reconciliation

- Accounts Payable and Receivable Management

- Payroll Calculation and TDS/PF/ESI Payments

- TDS Return Filing

- GST Return Filing

- Yearly Tax Return Filing

- Monthly Balance Sheet and Profit & Loss Reporting

- Financial Ratios Analysis and Reporting

- Inventory Management and Reconciliation

- Quarterly and Yearly Budgeting

- CFO Advisory Services (Quarterly)

- Tax Planning Services

Established

- Full-Time Dedicated Bookkeeping

- Highly Experienced Accounting Services

- Bank and Credit Card Reconciliation

- Accounts Payable and Receivable Management

- Payroll Calculation and TDS/PF/ESI Payments

- TDS Return Filing

- GST Return Filing

- Yearly Tax Return Filing

- Monthly Balance Sheet and Profit & Loss Reporting

- Financial Ratios Analysis and Reporting

- Inventory Management and Reconciliation

- Quarterly and Yearly Budgeting

- Cash, Revenue, and Expenses Forecasting

- KPI Reporting

- Strategic Advice on Revenue, Expenses, and Cash Flow Management

- Tax Planning

Optimize Business Finances with Online Bookkeeping

Bookkeeping is essential for businesses of all sizes as it transforms data into accurate future predictions. The main tasks include gathering, filing, and organizing financial data. Proper bookkeeping offers both immediate and long-term benefits. Online bookkeeping services help maintain accurate financial records, save time on manual tasks, and keep records current. Choosing the right provider for outsourced bookkeeping can significantly improve your process.

At SGP Advisors, we provide efficient, effective outsourced bookkeeping for businesses of all sizes. Our customizable, affordable virtual services cater to diverse needs, offering flexibility and scalability.

FAQ

Frequently Asked Questions (FAQs)

Bookkeeping is the process of recording financial transactions and maintaining accurate financial records for a business. This includes tracking income, expenses, assets, and liabilities.

Bookkeeping is crucial for managing finances, making informed business decisions, ensuring compliance with tax regulations, and providing transparency to stakeholders.

Key responsibilities include recording financial transactions, reconciling bank statements, managing accounts payable and receivable, maintaining the general ledger, and preparing financial reports.

Bookkeeping involves the day-to-day recording of financial transactions, while accounting includes interpreting, classifying, analyzing, reporting, and summarizing financial data.

There are two main types: single-entry bookkeeping and double-entry bookkeeping. Single-entry involves recording each transaction once, while double-entry records each transaction twice, as a debit and a credit, to maintain balance in the accounting equation.

Yes, many businesses choose to outsource bookkeeping to professional bookkeeping services to save time, reduce errors, and ensure accuracy and compliance.

Benefits include cost savings, access to expertise, improved accuracy, time savings, and the ability to focus on core business activities.

Consider factors such as experience, reputation, services offered, technology used, pricing, and client reviews when selecting a bookkeeping service provider.

Bookkeeping tasks should be performed regularly, such as daily, weekly, or monthly, depending on the size and complexity of the business.